Do you want to start call center business?

Are you thinking of opening a call center? There is no doubt this is a great business venture with immense potential. In the recent years, the telemarketing industry has been experiencing a steady growth of between 6.5% and 8% per annum. The quest for organizations to improve their customer service in order to outshine their competitors has compelled many firms to outsource their telemarketing to experts. This is a cost effective approach compared to investing in an in-house call center. To succeed, a number of issues have to be taken care of but you can be assured to recover your capital within the first three years.

Executive Summary

2.1 The Business

The call center will be registered under the name ListeningU, and will be situated in downtown Brentwood, Los Angeles- California. The call center will be owned and managed by Adam Bruno who is an expert customer service professional.

2.2 Management Team

Adam Bruno is a Customer Service professional who has worked in the customer care industry for more than a decade. Before planning how to create a call center, Adam worked for many top business companies across the United States and is an accomplished customer service expert.

2.3 Customer Focus

ListeningU intends to offer clients a one stop, modern and fully equipped call center with the latest telemarketing technologies to serve the Los Angeles business community.

2.4 Business Target

ListeningU intends to offer both inbound and outbound call center business strategy services to a wide range of clientele keen on outsourcing their call center services.

Company Summary

3.1 Company Owner

Adam Bruno is a customer care professional who has worked with renowned U.S brands that include JPMorgan Chase, Goldman Sachs, Wells Fargo and Citigroup. In the course of his career, he ascended to the position of a Customer Service Manager and took the lead role in structuring call center operations and overseeing all management related aspects.

3.2 Aim of Starting the Business

After having been in the career for long, Adams noticed that companies were spending a lot of time and resources to manage in-house call centers. In order to help businesses focus on their core operations, Bruno found it necessary to start a call center business to handle telemarketing services on behalf of clients.

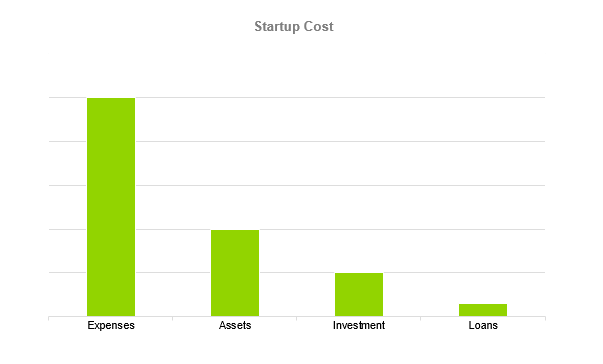

3.3 How the Business will be Started

As a customer service expert, Adams understands what he needs to start the call center. To set his idea into motion, he has worked closely with business set-up experts to develop a financial roadmap for the call center. The following is financial data for ListeningU Call Center.

| Start-up Expenses | |

| Legal | $4,000 |

| Consultants | $3,000 |

| Insurance | $15,000 |

| Rent | $20,000 |

| Research and Development | $8,000 |

| Expensed Equipment | $22,000 |

| Signs | $3,000 |

| TOTAL START-UP EXPENSES | $75,000 |

| Start-up Assets | $0 |

| Cash Required | $80,000 |

| Start-up Inventory | $25,000 |

| Other Current Assets | $30,000 |

| Long-term Assets | $8,000 |

| TOTAL ASSETS | $25,000 |

| Total Requirements | $20,000 |

| START-UP FUNDING | $0 |

| START-UP FUNDING | $100,000 |

| Start-up Expenses to Fund | $30,000 |

| Start-up Assets to Fund | $32,000 |

| TOTAL FUNDING REQUIRED | $0 |

| Assets | $20,000 |

| Non-cash Assets from Start-up | $15,000 |

| Cash Requirements from Start-up | $0 |

| Additional Cash Raised | $60,000 |

| Cash Balance on Starting Date | $20,000 |

| TOTAL ASSETS | $0 |

| Liabilities and Capital | $0 |

| Liabilities | $0 |

| Current Borrowing | $0 |

| Long-term Liabilities | $0 |

| Accounts Payable (Outstanding Bills) | $0 |

| Other Current Liabilities (interest-free) | $0 |

| TOTAL LIABILITIES | $0 |

| Capital | $0 |

| Planned Investment | $0 |

| Investor 1 | $20,000 |

| Investor 2 | $15,000 |

| Other | $0 |

| Additional Investment Requirement | $0 |

| TOTAL PLANNED INVESTMENT | $120,000 |

| Loss at Start-up (Start-up Expenses) | $55,000 |

| TOTAL CAPITAL | $60,000 |

| TOTAL CAPITAL AND LIABILITIES | $40,000 |

| Total Funding | $110,000 |

Services for Customers

ListeningU Call Center is focused on offering professional telemarketing services to different types of clients. When planning how to open a call center, the business is focused on offering the following services.

- Offer customer service that includes handling inquiries on behalf of clients

- Carry out Market research and surveys for clients

- Provide first-level help desk support

- Assist in business development by helping clients with lead generation, database management, debt collection and message services.

Marketing Analysis for Call Center Business

For ListeningU Call Center to meet its market obligations, a detailed market analysis was carried out to help the business establish itself in the industry and adequately serve the needs of clients.

Note

This call center business plan explains the strategy the business will rely on to attain its goals. Given the rising demand for corporate call center services, there is a great opportunity for ListeningU to meet its market objectives.

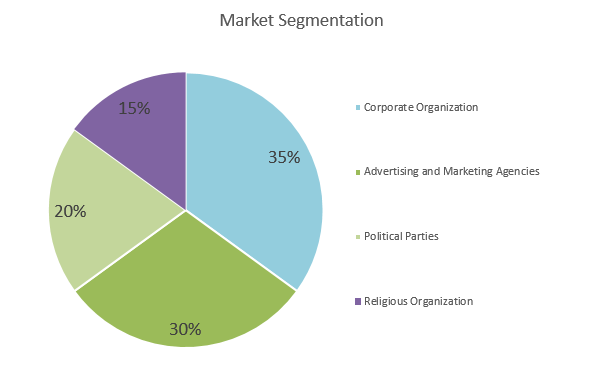

5.1 Market Segmentation

Given the increasing popularity of the call center industry, ListeningU understands the value of coming up with sustainable marketing strategies to acquire a larger market share. Being the second largest city in the United States, Los Angeles is a business hub with many corporates looking for quality call center services to support their business operations. Based on market findings, the call center intends to target the following potential customers.

5.1.1 Corporate Organizations

Business Plan for Investors

Corporate organizations rely on an infrastructure that allows seamless communication to achieve various business objectives. For this reason, every corporate entity needs a robust and flexible call center service that has the capability to accommodate business needs. With high costs associated with setting up, running and maintaining call centers, businesses now prefer to outsource their needs to professional call center companies.

The corporate sphere is large and ListeningU Call Center intends to target companies in various sectors such as banking, manufacturing, telecommunication and information technology among others. Organizations have to keep communicating with their clients, suppliers, business partners and other industry stakeholders. The call center business model will focus on reaching out directly to various corporate entities.

5.1.2 Advertising and Marketing Agencies

One of the main services offered by ListeningU is marketing and lead generation. Call centers play a major role in advertising and brand awareness which attracts marketing agencies intending to roll out advertising campaigns for various products and services. Thanks to investing in sophisticated and cutting edge technologies, the call center has invested in the appropriate infrastructure to support large scale advertising.

5.1.3 Political Parties

Political parties have been identified as a potential customer group to reach out to in this call center business plan sample. Political parties often conduct fundraising and campaigns which need a professional call center facility to handle all communication aspects on behalf of a client. Political parties always run elaborate campaigns in order to create awareness and outshine their competitors. For this reason, ListeningU Call Center stands a great chance to benefit from political parties.

5.1.4 Religious Organizations

With many religious organizations operating in Los Angeles, the demand for call centers is high as religious establishments are always in need to call centers to support various organization functions. Just like political parties, religious organizations engage in numerous fundraising and campaigns.

| Market Analysis | |||||||||

| Potential Customers | Growth | YEAR 1 | YEAR 2 | YEAR 3 | YEAR 4 | YEAR 5 | CAGR | ||

| Corporate Organization | 35% | 30,000 | 32,000 | 34,000 | 36,000 | 38,000 | 10.00% | ||

| Advertising and Marketing Agencies | 30% | 25,000 | 27,000 | 29,000 | 31,000 | 33,000 | 9.00% | ||

| Political Parties | 20% | 20,000 | 22,000 | 24,000 | 26,000 | 28,000 | 12.00% | ||

| Religious Organizations | 15% | 15,000 | 17,000 | 19,000 | 21,000 | 23,000 | 11.00% | ||

| Total | 100% | 90,000 | 98000 106,000 | 114,000 | 122,000 | 13.00% | |||

5.2 Business Target

ListeningU Call Center is getting into a highly competitive environment considering there are numerous call centers in Los Angeles. However, this call center business plan template outlines the plan the business intends to use to acquire clients and propel business growth. It is costly to set up a fully functioning call center, but adequate strategies have been formulated to help the business fully recover its initial capital. After finalizing how to build a call center business and rolling out operations, the call center expects to recoup its initial investment in three years based on a projected 15-20% annual sales growth.

5.3 Product Pricing

While strategizing on how to start a call center business, Adam Bruno together with the assistance of experts has come up with a competitive pricing structure tailored for different services. At the beginning, the call center intends to offer various incentives to attract clients.

Strategy

excellent work

excellent work, competent advice.

Alex is very friendly, great communication.

100% I recommend CGS capital.

Thank you so much for your hard work!

When planning how to start a call center, you need to come up with a great business development strategy. Adam Bruno has engaged experts to formulate a call center strategy that will be instrumental to steer business growth. The following is ListeningU Call Center sales strategy.

6.1 Competitive Analysis

ListeningU has deployed the latest telemarketing technologies to boost efficiency and seamlessly handle multiple clients without compromising quality. After completing the procedures of how to build a call center, the business anticipates high competition considering there are numerous similar establishments in Brentwood.

6.2 Sales Strategy

For ListeningU to achieve its intended targets and create a call center which is popular with clients, the following sales strategy will be implemented.

- Hire professional marketing agencies to help advertise the call center and teach out to corporate clients

- Organize an official opening party and welcome top industry stakeholders to create awareness about the business

- Do cold calling and email various potential customers to advertise call center services

- Advertise on digital media platforms such as Facebook, Twitter and Instagram

- Use local media channels such as Television and newspapers to advertise the business

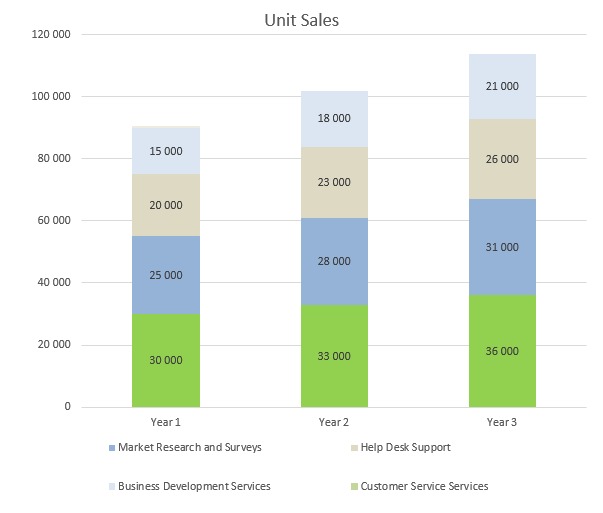

6.3 Sales Forecast

ListeningU Call Center has put in place various sales strategies in order to meet its targets. The following is a forecast of sales for the business.

| Sales Forecast | |||

| Unit Sales | Year 1 | Year 2 | Year 3 |

| Customer service services | 500,000 | 520,000 | 540,000 |

| Market research and surveys | 400,000 | 420,000 | 440,000 |

| Help desk support | 300,000 | 320,000 | 340,000 |

| Business development services | 200,000 | 220,000 | 240,000 |

| TOTAL UNIT SALES | 1,400,000 | 1,480,000 | 1,560,000 |

| Unit Prices | Year 1 | Year 2 | Year 3 |

| Customer service services | $400.00 | $410.00 | $420.00 |

| Market research and surveys | $300.00 | $310.00 | $320.00 |

| Help desk support | $200.00 | $210.00 | $220.00 |

| Business development services | $150.00 | $160.00 | $170.00 |

| Sales | |||

| Customer service services | $300,000 | $310,000 | $320,000 |

| Market research and surveys | $250,000 | $260,000 | $270,000 |

| Help desk support | $200,000 | $210,000 | $220,000 |

| Business development services | $150,000 | $160,000 | $170,000 |

| TOTAL SALES | |||

| Direct Unit Costs | Year 1 | Year 2 | Year 3 |

| Customer service services | $5.00 | $6.00 | $7.00 |

| Market research and surveys | $4.00 | $5.00 | $6.00 |

| Help desk support | $3.00 | $4.00 | $5.00 |

| Business development services | $2.00 | $3.00 | $4.00 |

| Direct Cost of Sales | |||

| Customer service services | $250,000 | $260,000 | $270,000 |

| Market research and surveys | $200,000 | $210,000 | $220,000 |

| Help desk support | $150,000 | $160,000 | $170,000 |

| Business development services | $100,000 | $110,000 | $120,000 |

| Subtotal Direct Cost of Sales | $700,000 | $740,000 | $780,000 |

Personnel Plan

ListeningU provides diverse services in order to boost the company’s income. When starting a call center business, it is vital to focus on having a good personnel team to handle business operations.

7.1 Personnel Plan

The call center is owned by Adam Bruno who will be the overall center manager for the business. The call center intends to hire the following staff to enable the business carry out its operations.

- Call Center Manager

- Operations Manager

- Two Marketing Executives

- Five Customer Service Representatives

- Successful candidates will undergo intensive training to understand procedures and expectations.

7.2 Average Staff Salaries

ListeningU Call Center plans to pay its staff the following salaries in the first three years of operations.

| Personnel Plan | |||

| Year 1 | Year 2 | Year 3 | |

| Manager | $50,000 | $55,000 | $60,000 |

| Cashier | $30,000 | $35,000 | $40,000 |

| Administrator | $28,000 | $34,000 | $38,000 |

| 1 Sales and Marketing Executive | $30,000 | $35,000 | $40,000 |

| 5 Customer Care Representatives | $90,000 | $105,000 | $120,000 |

| Cleaner | $20,000 | $25,000 | $30,000 |

| Assitant Manager | $40,000 | $45,000 | $50,000 |

| Total Salaries | $288,000 | $333,000 | $378,000 |

Financial Plan

ListeningU Call Center has formulated a financial plan that will steer the path to business success. To start call center business, Adam will use his personal savings and funds from two investors. A loan will be sought to help raise startup capital for the business. Crucial financial information for the call center has been shown below.

8.1 Important Assumptions

Financial forecast for ListeningU Call Center will be based on the following assumptions.

| General Assumptions | |||

| Year 1 | Year 2 | Year 3 | |

| Plan Month | 1 | 2 | 3 |

| Current Interest Rate | 10.00% | 12.00% | 14.00% |

| Long-term Interest Rate | 5.00% | 5.00% | 5.00% |

| Tax Rate | 12.00% | 14.00% | 16.00% |

| Other | 0 | 0 | 0 |

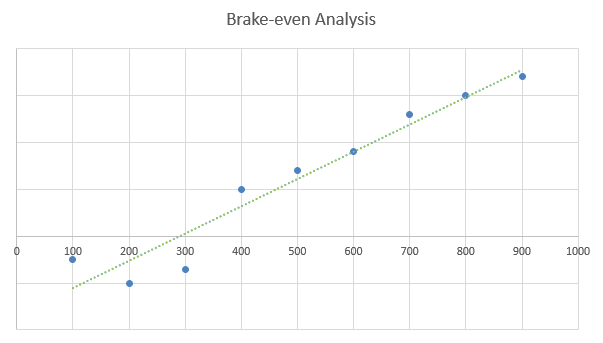

8.2 Brake-even Analysis

ListeningU Brake-even Analysis is indicated in the graph below.

| Brake-Even Analysis | |

| Monthly Units Break-even | 12000 |

| Monthly Revenue Break-even | $350,000 |

| Assumptions: | |

| Average Per-Unit Revenue | $200.00 |

| Average Per-Unit Variable Cost | $2.00 |

| Estimated Monthly Fixed Cost | $400,000 |

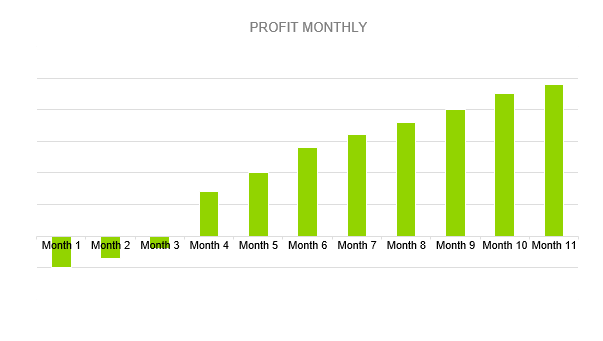

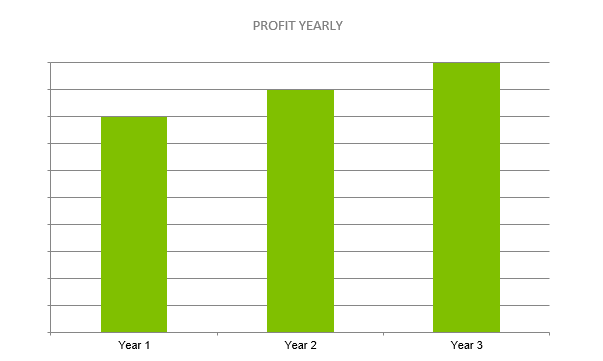

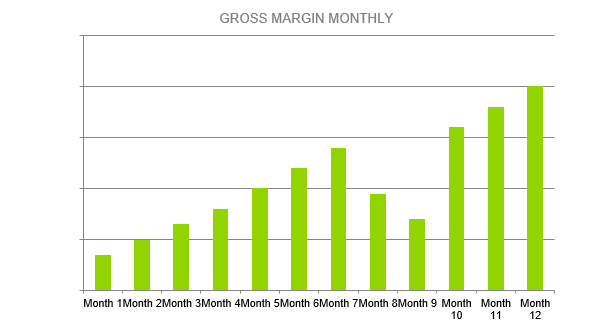

8.3 Projected Profit and Loss

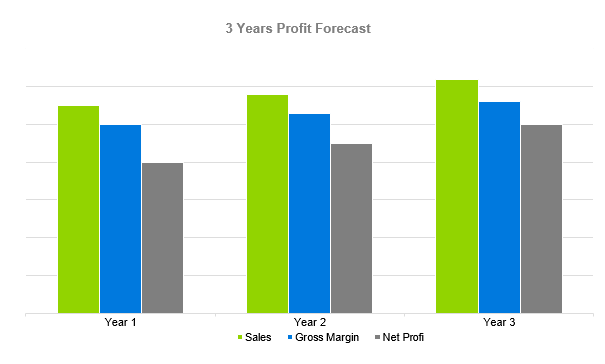

Profit and Loss information for ListeningU calculated on a monthly and annual basis is shown below.

| Pro Forma Profit And Loss | |||

| Year 1 | Year 2 | Year 3 | |

| Sales | $700,000 | $730,000 | $760,000 |

| Direct Cost of Sales | $40,000 | $60,000 | $80,000 |

| Other | $0 | $0 | $0 |

| TOTAL COST OF SALES | $40,000 | $60,000 | $80,000 |

| Gross Margin | $420,000 | $460,000 | $500,000 |

| Gross Margin % | 75.00% | 80.00% | 85.00% |

| Expenses | |||

| Payroll | $300,000 | $320,000 | $340,000 |

| Sales and Marketing and Other Expenses | $5,000 | $7,000 | $9,000 |

| Depreciation | $4,000 | $6,000 | $8,000 |

| Leased Equipment | $0 | $0 | $0 |

| Utilities | $6,000 | $8,000 | $10,000 |

| Insurance | $2,000 | $3,000 | $4,000 |

| Rent | $12,000 | $14,000 | $16,000 |

| Payroll Taxes | $32,000 | $36,000 | $40,000 |

| Other | $0 | $0 | $0 |

| Total Operating Expenses | $230,000 | $260,000 | $290,000 |

| Profit Before Interest and Taxes | $55,000 | $65,000 | $80,000 |

| EBITDA | $10,000 | $15,000 | $20,000 |

| Interest Expense | $0 | $0 | $0 |

| Taxes Incurred | $15,000 | $20,000 | $25,000 |

| Net Profit | $120,000 | $130,000 | $140,000 |

| Net Profit/Sales | 20.00% | 35.00% | 50.00% |

8.3.1 Monthly Profit

8.3.2 Yearly Profit

8.3.3 Monthly Gross Margin

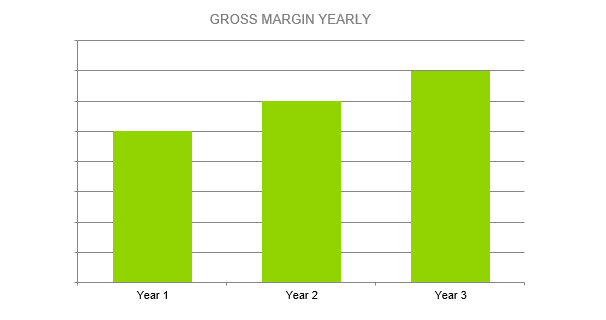

8.3.4 Yearly Gross Margin

Below is the profit and Loss Analysis for ListeningU Call Center.

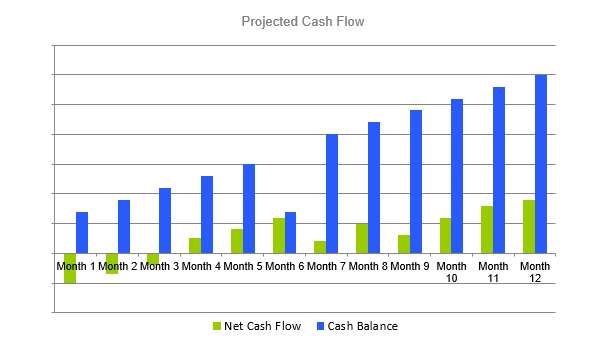

8.4 Projected Cash Flow

Below is the profit and Loss Analysis for ListeningU Call Center.

The diagram below is a summary of subtotal cash spent, subtotal cash from operations, subtotal cash spent on operations, subtotal cash received and pro forma cash flow.

| Pro Forma Cash Flow | |||

| Cash Received | Year 1 | Year 2 | Year 3 |

| Cash from Operations | |||

| Cash Sales | $50,000 | $55,000 | $60,000 |

| Cash from Receivables | $8,000 | $10,000 | $12,000 |

| SUBTOTAL CASH FROM OPERATIONS | $58,000 | $65,000 | $72,000 |

| Additional Cash Received | |||

| Sales Tax, VAT, HST/GST Received | $0 | $0 | $0 |

| New Current Borrowing | $0 | $0 | $0 |

| New Other Liabilities (interest-free) | $0 | $0 | $0 |

| New Long-term Liabilities | $0 | $0 | $0 |

| Sales of Other Current Assets | $0 | $0 | $0 |

| Sales of Long-term Assets | $0 | $0 | $0 |

| New Investment Received | $0 | $0 | $0 |

| SUBTOTAL CASH RECEIVED | $58,000 | $65,000 | $72,000 |

| Expenditures | Year 1 | Year 2 | Year 3 |

| Expenditures from Operations | |||

| Cash Spending | $20,000 | $22,000 | $24,000 |

| Bill Payments | $15,000 | $20,000 | $25,000 |

| SUBTOTAL SPENT ON OPERATIONS | $35,000 | $42,000 | $49,000 |

| Additional Cash Spent | |||

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 |

| Principal Repayment of Current Borrowing | $0 | $0 | $0 |

| Other Liabilities Principal Repayment | $0 | $0 | $0 |

| Long-term Liabilities Principal Repayment | $0 | $0 | $0 |

| Purchase Other Current Assets | $0 | $0 | $0 |

| Purchase Long-term Assets | $0 | $0 | $0 |

| Dividends | $0 | $0 | $0 |

| SUBTOTAL CASH SPENT | $35,000 | $45,000 | $55,000 |

| Net Cash Flow | $12,000 | $15,000 | $18,000 |

| Cash Balance | $23,000 | $28,000 | $33,000 |

8.5 Projected Balance Sheet

The following is a Projected Balance Sheet for ListeningU Call Center that shows capital, assets, long term assets, liabilities and current liabilities.

| Pro Forma Balance Sheet | |||

| Assets | Year 1 | Year 2 | Year 3 |

| Current Assets | |||

| Cash | $280,000 | $310,000 | $340,000 |

| Accounts Receivable | $20,000 | $22,000 | $25,000 |

| Inventory | $5,000 | $8,000 | $11,000 |

| Other Current Assets | $4,000 | $8,000 | $12,000 |

| TOTAL CURRENT ASSETS | $309,000 | $348,000 | $388,000 |

| Long-term Assets | |||

| Long-term Assets | $8,000 | $11,000 | $14,000 |

| Accumulated Depreciation | $12,000 | $15,000 | $18,000 |

| TOTAL LONG-TERM ASSETS | $5,000 | $3,000 | $1,000 |

| TOTAL ASSETS | $210,000 | $270,000 | $320,000 |

| Liabilities and Capital | Year 1 | Year 2 | Year 3 |

| Current Liabilities | |||

| Accounts Payable | $18,000 | $21,000 | $24,000 |

| Current Borrowing | $0 | $0 | $0 |

| Other Current Liabilities | $0 | $0 | $0 |

| SUBTOTAL CURRENT LIABILITIES | $18,000 | $21,000 | $24,000 |

| Long-term Liabilities | $0 | $0 | $0 |

| TOTAL LIABILITIES | $18,000 | $21,000 | $24,000 |

| Paid-in Capital | $30,000 | $30,000 | $30,000 |

| Retained Earnings | $50,000 | $55,000 | $60,000 |

| Earnings | $120,000 | $130,000 | $140,000 |

| TOTAL CAPITAL | $218,000 | $236,000 | $254,000 |

| TOTAL LIABILITIES AND CAPITAL | $200,000 | $210,000 | $230,000 |

| Net Worth | $240,000 | $270,000 | $300,000 |

8.6 Business Ratios

ListeningU Call Center Business Ratios, Ratio Analysis and Business Net Worth are shown below.

| Ratio Analysis | ||||

| Year 1 | Year 2 | Year 3 | INDUSTRY PROFILE | |

| Sales Growth | 10.00% | 24.00% | 60.00% | 6.00% |

| Percent of Total Assets | ||||

| Accounts Receivable | 8.00% | 6.00% | 3.00% | 14.00% |

| Inventory | 6.00% | 4.10% | 2.30% | 15.00% |

| Other Current Assets | 5.00% | 3.50% | 2.00% | 35.00% |

| Total Current Assets | 95.00% | 105.00% | 130.00% | 60.00% |

| Long-term Assets | -6.00% | -12.00% | -18.00% | 35.50% |

| TOTAL ASSETS | 100.00% | 100.00% | 100.00% | 100.00% |

| Current Liabilities | 7.00% | 5.00% | 3.00% | 30.00% |

| Long-term Liabilities | 0.00% | 0.00% | 0.00% | 25.00% |

| Total Liabilities | 7.20% | 3.00% | 4.40% | 40.00% |

| NET WORTH | 90.00% | 85.00% | 120.00% | 30.00% |

| Percent of Sales | ||||

| Sales | 100.00% | 100.00% | 100.00% | 100.00% |

| Gross Margin | 70.00% | 72.00% | 74.00% | 0.00% |

| Selling, General & Administrative Expenses | 60.00% | 75.00% | 62.00% | 50.00% |

| Advertising Expenses | 3.00% | 2.00% | 0.50% | 5.00% |

| Profit Before Interest and Taxes | 22.00% | 25.00% | 28.40% | 3.00% |

| Main Ratios | ||||

| Current | 16 | 20 | 24 | 2.6 |

| Quick | 30 | 33 | 36 | 5.5 |

| Total Debt to Total Assets | 6.00% | 3.00% | 2.40% | 45.00% |

| Pre-tax Return on Net Worth | 90.00% | 95.00% | 100.00% | 3.40% |

| Pre-tax Return on Assets | 45.00% | 65.00% | 55.00% | 9.00% |

| Additional Ratios | Year 1 | Year 2 | Year 3 | |

| Net Profit Margin | 12.00% | 17.00% | 22.00% | N.A. |

| Return on Equity | 60.00% | 64.00% | 68.00% | N.A. |

| Activity Ratios | ||||

| Accounts Receivable Turnover | 6 | 8 | 10 | N.A. |

| Collection Days | 100 | 110 | 120 | N.A. |

| Inventory Turnover | 20 | 23 | 25 | N.A. |

| Accounts Payable Turnover | 15 | 18 | 21 | N.A. |

| Payment Days | 23 | 23 | 23 | N.A. |

| Total Asset Turnover | 3.4 | 2.4 | 1.2 | N.A. |

| Debt Ratios | ||||

| Debt to Net Worth | 0 | -0.08 | -0.06 | N.A. |

| Current Liab. to Liab. | 0 | 0 | 0 | N.A. |

| Liquidity Ratios | ||||

| Net Working Capital | $300,000 | $320,000 | $340,000 | N.A. |

| Interest Coverage | 0 | 0 | 0 | N.A. |

| Additional Ratios | ||||

| Assets to Sales | 2.45 | 1.48 | 0.65 | N.A. |

| Current Debt/Total Assets | 8% | 6% | 4% | N.A. |

| Acid Test | 32 | 35 | 38 | N.A. |

| Sales/Net Worth | 3.4 | 2.6 | 1.8 | N.A. |

| Dividend Payout | 0 | 0 | 0 | N.A. |

Download Dog Walking Business Plan Sample in pdf

OGS capital professional writers specialized also in themes such as headhunter business plan, business plan for running staffing consultation and many others.

(3 votes, average: 3.33 out of 5)

(3 votes, average: 3.33 out of 5)

Add comment

Comments (0)